Brief Background:

- The state’s pension obligations cost more than $12.5 billion each year.

- According to a recent Moody’s Report, Illinois’ public pensions are the most chronically underfunded in the nation.

- The state was not able to cover the 2011 payment to the pension fund out of current revenues. The General Assembly passed legislation to borrow money to cover most of this payment, which will be paid off over the next eight years.

Solutions?

The existing pension debt could be addressed by any combination of:

- raising new tax revenue

- cutting spending on other programs

- reneging on the promise to pay existing benefits

Proposals for Change Being Floated:

Beginning in January of 2011, the state altered the pension program for new employees by reducing the level of pension benefits. Legislation has been introduced, but not adopted, to reduce the level of future pension benefits accumulated by current employees.

- The state could alter the program for new and/or existing employees by keeping the basic structure in place but reducing the level of pension benefits.

- Increased employee contributions. This means that current employees could accept mandatory increases in their contributions, or retired employees could add to the fund through a tax on pension income (in Illinois, pension income is currently tax exempt).

- The state could eliminate the defined benefit program and only offer a defined contribution program. This does not necessarily influence the cost or generosity of the program, but it forces the government to pay pension benefits upfront.

What about the legal side of the pension issue?

It’s impossible to predict the outcome of any legal challenge but the Illinois Supreme Court has in earlier cases indicated that the Pension Clause should apply to protect the acquired benefits of current employees. No judicial opinions have resolved the question whether the legislature could modify pension benefits.

Is every category of state employee affected?

Most public sector employees participate in a state pension program and could be affected by changes. State resources are scarce and policymakers have to trade off funding for pensions with many other programs. Changes to the pension program, therefore, affect the entire state budget and the ability to fund other programs.

Will anything happen this year?

The magnitude of the problem makes it nearly certain that the legislature will have to take action this year (beyond borrowing) to address the future solvency of the pension funds. However, it is uncertain which course of action the state leaders will choose to take.

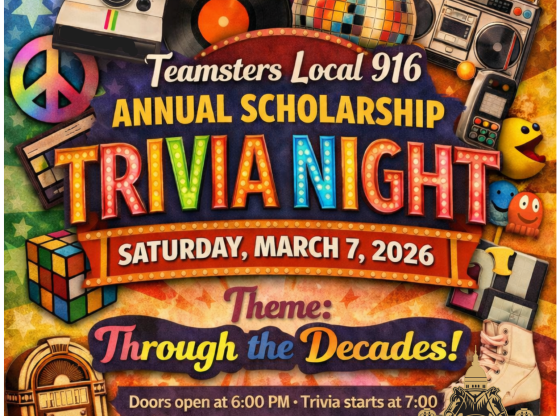

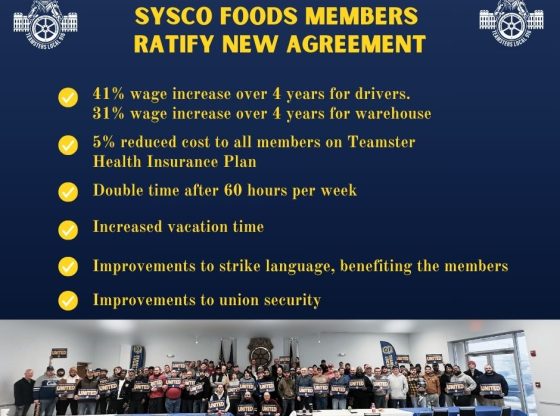

Teamsters Local 916 proudly represents over 4,000 hardworking men and women throughout the State of Illinois in the private and public sectors.