Pension Changes Will Affect More Than 2,000 Members

NOTE: Local 916 will continue to update members on the status of this legislation and legal challenges to it, as well as provide information important to members and their retirement planning. Barring a successful court challenge, the legislation takes effect July 1, 2014. SUMMARY: The provisions of the bill affect active members, inactive members and retirees of SERS as outlined below. The bill does not reduce the current monthly benefit amounts of retirees and it does not eliminate or reduce COLAs that have already been received. It reduces COLAS prospectively beginning in January 2015.Defined Benefit (DB) Changes

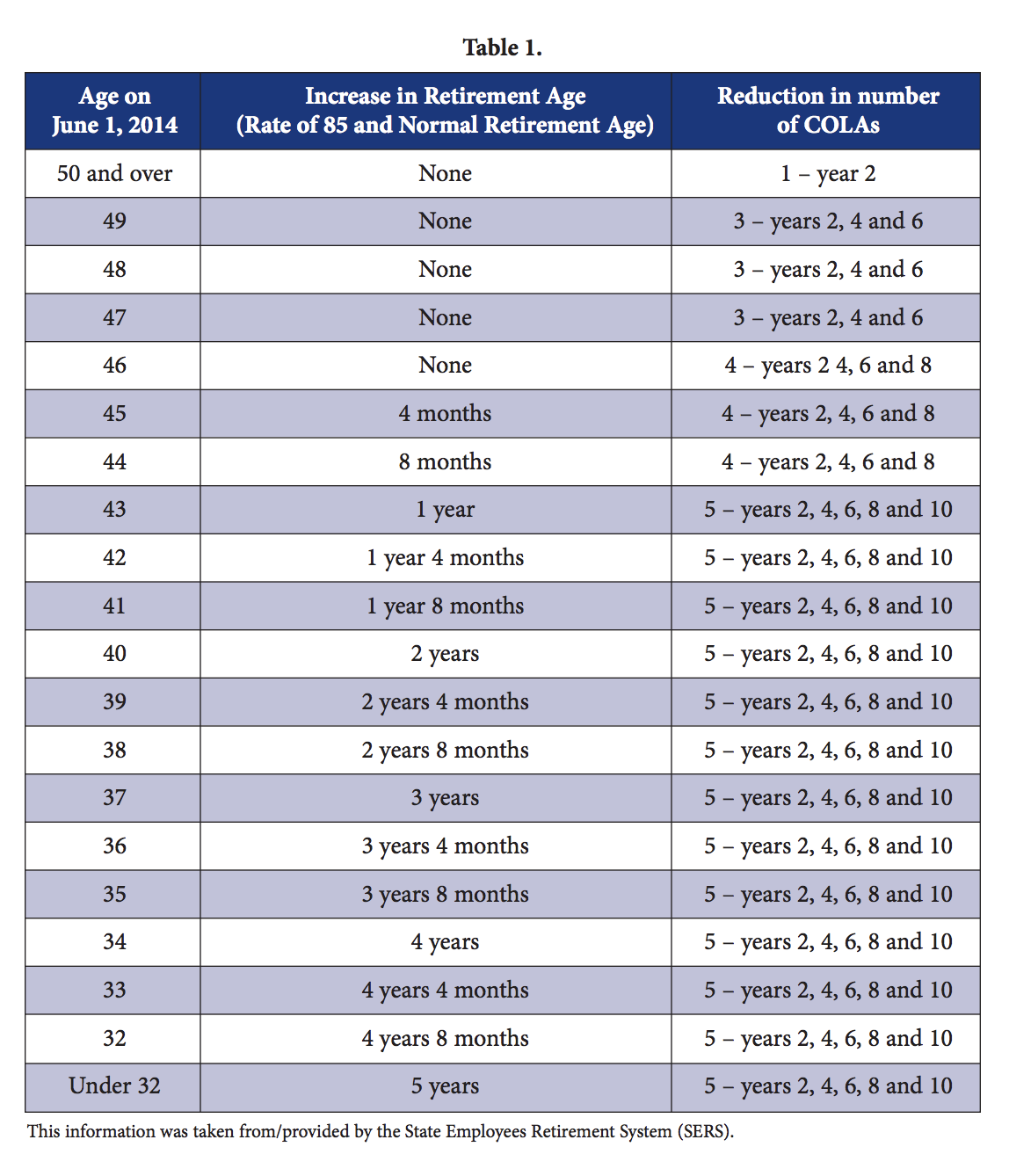

Maximum Annual Adjustments (COLAs) Beginning January 2015, the 3% COLAs will be applied to the lesser of the actual annuity, or the number of years of a retiree’s service credit multiplied by $1,000 for service not covered by Social Security or $800 for service covered by Social Security (maximum COLA amount). The maximum COLA ($1,000 or $800 per year of service) will be indexed each year by the growth in the Consumer Price Index (CPI). Those with an annuity that is less than their years of service multiplied by the applicable $1,000 or $800, or what these amounts have grown to at the time of retirement, will receive a 3% COLA compounded each year until the annuity reaches the maximum COLA amount. There is no limit on the number of years of service credit that can be used in the maximum COLA calculation. Survivor annuities and disability annuities will continue to receive 3% compounded COLAs on the entire annuity amount. Skipped COLAs Employees who retire on or after July 1, 2014 will have annual adjustments skipped depending on age at the effective date: employees age 50 or over, 1 COLA skipped (year 2); employees age 47 to 49 will have 3 COLAs skipped (years 2, 4, and 6); employees age 44 to 46 will have 4 COLAs skipped (years 2, 4, 6, and 8); employees age 43 and under, 5 COLAs skipped (years 2, 4, 6, 8, 10). Please refer to Table 1. Pensionable Salary Cap Applies the Tier II salary cap ($110,631 for 2014) to all Tier 1 members. This cap is adjusted annually by the lesser of 3% or one half of the annual CPI. Salaries that currently exceed the cap or that will exceed the cap based on raises in a collective bargaining agreement are grandfathered in. Retirement Age For employees age 45 or younger on June 1, 2014, the retirement age is increased on a graduated scale. For each year a member is under 46, the retirement age will be increased by 4 months (up to a 5 year increase for members under age 32 on June 1, 2014). The incremental increase in retirement age applies to all formulas and the Rule of 85. Please refer to Table 1. Employee Contributions Beginning July 1, 2014, all SERS employee contribution rates will decrease by 1%.Optional Defined Contribution (DC) Plan

Defined Contribution Plan Beginning July 1, 2015, up to 5% of Tier 1 active members can make an irrevocable election to switch from the DB plan to a DC plan. Employee contributions to the DC plan will be equal to those of the DB plan. Employer contributions to the DC plan will change annually and must be at least 3% but not higher than the employer’s cost of the DB benefits. The employee must participate in the DC plan for at least 5 years to become vested in the employer contributions made to their DC account. When a member opts into the DC plan, benefits previously accrued in the DB plan will be frozen.Funding Changes

Funding Schedule A funding schedule is established that will achieve 100% funding no later than the end of FY 2044. Contributions will be certified using the entry age normal (EAN) actuarial cost method, which spreads costs evenly over an employee’s career and results in level employer contributions. Supplemental Contributions The State will contribute (i) $364 million in FY 2019, (ii) $1 billion annually thereafter through 2045 or until the system reaches 100% funding, and (iii) 10% of the annual savings resulting from pension reform beginning in FY 2016 until the system reaches 100% funding. The supplemental contributions will be divided among the State-funded retirement systems. Funding Guarantee If the State fails to make a required annual or supplemental contribution, SERS may file an action in the Illinois Supreme Court to compel the State to make the required annual or supplemental contribution. Teamsters Local 916 proudly represents over 4,000 hardworking men and women throughout the State of Illinois in the private and public sectors.

Teamsters Local 916 proudly represents over 4,000 hardworking men and women throughout the State of Illinois in the private and public sectors.